5-6-2025 Executive Summary

The investment landscape may be ready for a seismic shift. For decades, long/short hedge funds offered investors sophisticated strategies with the potential for alpha generation in both rising and falling markets. However, these benefits often come at a steep cost: high fees, limited transparency, illiquidity, and onerous lock-up periods.

In response, a new vehicle emerged - the long/short ETF - that combines a strategy previously available only to institutional investors with the accessibility and efficiency of the ETF wrapper. This paper explores the reasons we believe long/short ETFs will quickly become the preferred vehicle for sophisticated investors.

The Rise of Long/Short ETFs

The ETF market has evolved far beyond passive index replication. A new generation of actively managed ETFs offers dynamic, research-driven strategies—many of which rival or have outperformed traditional hedge funds.

Long/short ETFs like The Future Fund’s Long/Short ETF (FFLS) provide investors with a liquid, transparent, and cost-effective way to gain exposure to long/short equity strategies previously reserved for institutional or high-net-worth investors.

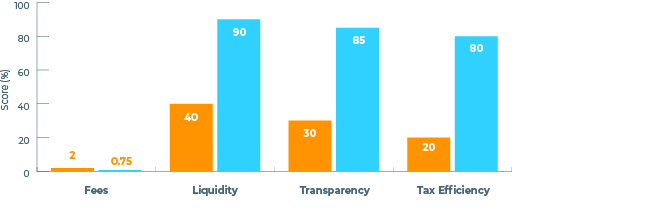

2. Key Advantages Over Hedge Funds

Liquidity: Long/short ETFs trade intra-day on public exchanges, allowing investors to enter or exit positions at will, unlike hedge funds which often have quarterly redemptions.

Transparency: Daily holdings disclosures provide insight into positioning and risk exposure. This contrasts with hedge funds, which typically offer minimal transparency.

Fees: ETFs charge significantly lower fees compared with the traditional “2 and 20” model of hedge funds. FFLS, for example, is managed with a similar strategy at a fraction of the cost.

Tax Efficiency: ETFs benefit from the in-kind creation/redemption mechanism, potentially reducing capital gains distributions for investors.

3. Case Study: FFLS – The Future Fund Long/Short ETF

FFLS represents a high-conviction, research-driven approach to long/short investing. The strategy capitalizes on secular megatrends by identifying companies at inflection points for long positions, while shorting those facing structural headwinds.

Managed by seasoned portfolio managers Gary Black and David Kalis, FFLS has demonstrated the ability to navigate volatility and protect capital during drawdowns - key benefits investors traditionally sought in hedge funds.

4. Portfolio Applications

Diversification: Long/short ETFs have been shown to reduce portfolio correlation to traditional equity markets.

Risk Management: The short component provides a hedge during market downturns.

Tactical Exposure: Advisors and CIOs can use long/short ETFs for thematic or macro-driven positioning.

5. The Future of Alternatives is Transparent

Investors increasingly demand liquidity, clarity, and cost efficiency. Long/short ETFs meet these needs without compromising on strategy sophistication. As capital continues to migrate from opaque, expensive vehicles to transparent alternatives, long/short ETFs are positioned to become a cornerstone in modern portfolios.

Visual Comparison: Hedge Funds vs. Long/Short ETFs

As reported January - March 2004

Sources and Dates:

Fees: Hedge Fund Research (HFR) 2024 Global Hedge Fund Industry Report: Wall Street Journal, “Hedge Funds Still High-Cost

Despite Industry Pressure,” January 2024.

Liquidity: Investment Law Group, “2024 Hedge Fund Liquidity Overview,” White Paper, February 2024.

Transparency: ETF.com 2024 ETF Transparency Report; The Hedge Fund Journal, “Operational Due Diligence Trends 2024,” March 2024.

Tax Efficiency: Goldman Sachs Asset Management; “ETF Tax Efficiency: 2024 Investor Guide”; Investopedia Tax Guide, 2024 Edition.

Conclusion

Hedge funds once held a monopoly on sophisticated long/short investing. Today, innovation in the ETF space has democratized access to these strategies. For RIAs, wealth managers, and family offices seeking alpha with accountability, long/short ETFs offer a compelling modern alternative.

About The Future Fund

The Future Fund is an independent investment firm focused on high-conviction, actively managed

ETFs that invest in transformational companies shaping tomorrow’s economy. Led by seasoned investors Gary Black and David Kalis, the firm’s disciplined investment management strategies are available in accessible, transparent vehicles for investors.

Learn more about The Future Fund Long/Short ETF at futurefundetf.com.

IMPORTANT INFORMATION

Investing involves risk, including loss of principal. There is no guarantee that the Fund will achieve its investment objectives. In general, prices of equity securities are more volatile than those of fixed income securities. The prices of equity securities fluctuate in response to issuer-specific activities as well as factors unrelated to the fundamental condition of the issuer, including general market, economic and political conditions along with other factors. While the shares of ETFs trade on secondary markets, they may not readily trade in all market conditions and may trade at significant discounts in periods of market stress.

Long/Short investing: A long/short strategy seeks to balance investments by holding long positions in stocks expected to do well and short positions in stocks expected to underperform. Long investing involves buying an asset, such as stocks, with the expectation that its price will increase over time. The investor holds the asset for an extended period to benefit from potential price appreciation and any dividends or interest it may generate. Shorting, or short selling, involves borrowing shares of a stock and selling them at the current market price, with the expectation that the price will decline. The investor plans to buy back the shares at a lower price to return them to the lender.

Short selling involves the sale of securities borrowed from a third party. The short seller profits if the borrowed security’s price declines. If a shorted security increases in value, a higher price must be paid to buy the stock back to cover the short sale, resulting in a loss. The Fund may incur expenses related to short selling, including compensation, interest or dividends, and transaction costs payable to the security lender, whether the price of the shorted security increases or decreases. The amount the Fund could lose on a short sale is theoretically unlimited. Short selling also involves counterparty risk – the risk associated with the third party ceasing operations or failing to sell the security back.

The Fund is actively managed and is thus subject to management risk. The Advisor will apply its investment techniques and strategies in making investment decisions for the Fund, but there is no guarantee that its techniques will produce the intended results. Derivative risk is the possibility that an investor will not be able to sell a derivative position at a reasonable price or quickly. Leverage risk is the possibility that losses will be magnified when using borrowed money to increase the potential returns of an investment. This is because leverage can also multiply losses if the income from the asset is less than the financing costs or the value of the asset decreases. Limited history of operations: FFLS is a relatively new ETF with only two years history for investors to evaluate. Shareholders may pay more than NAV when buying Fund shares and receive less than NAV when selling Fund shares, because shares are bought and sold at current market prices. Shares of FFLS are bought and sold at market price (not NAV) and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

Investors should consider the investment objectives, risks, and charges and expenses of the Funds before investing. The FFND prospectus and the FFLS prospectus contains this and other information about the Funds and should be read carefully before investing. The prospectuses may also be obtained by calling 877.466.7090.

The Future Fund Long/Short ETF is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC. The Future Fund LLC is the investment advisor to the Funds, and is not affiliated with Northern Lights Distributors, LLC.