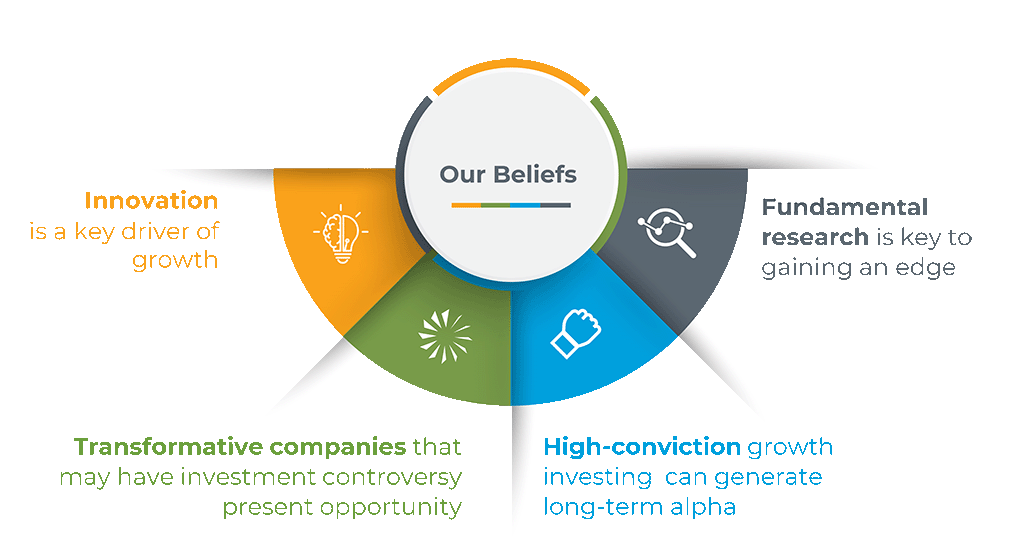

ABOUT THE FUTURE FUND LLC, ADVISER TO THE ETFs

The Future Fund LLC, adviser to The Future Fund ETFs, is an SEC-Registered Advisor. We’ve identified megatrends that we believe are the most influential multi-year secular growth opportunities shaping the future.

Our focus is on companies that can change the world by capitalizing on these fundamental changes in their markets.